Sliding Fee Discount Program

The Sliding Fee Discount Program is designed to offer significant discounts to individuals and families who qualify on the basis of limited income and/or family size. These are available for all of our health centers and apply to all in-scope services. Valley Health strives to ensure that quality healthcare is readily accessible to everyone & serves patients regardless of their ability to pay.

Sliding Fee Policy (Simple Chinese)

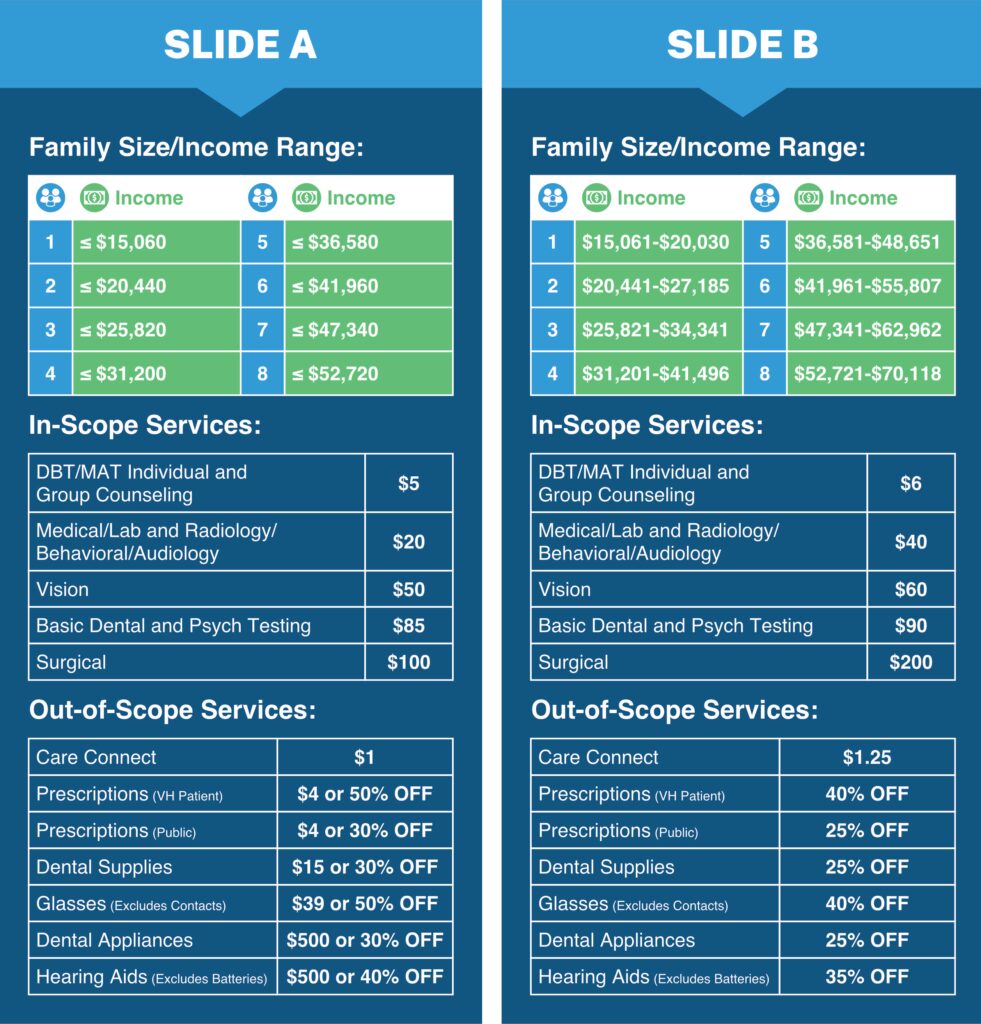

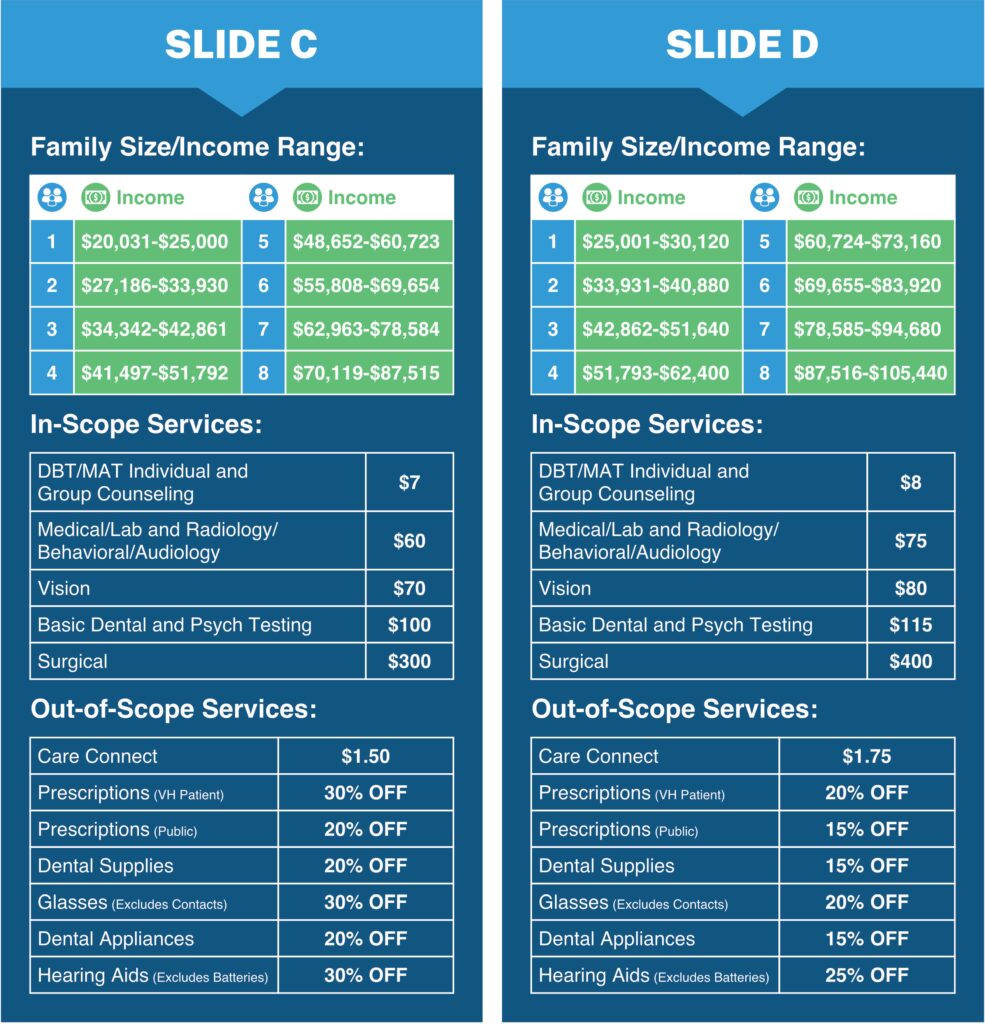

Income and Family Size Eligibility

Anyone is welcome to apply for the Sliding Fee Discount Program including those who already have commercial insurance coverage. Eligibility is based on family size and income for those at or below 200% of the Federal Poverty Level.

How Can I Apply

Download a Sliding Fee Application and complete it. You can also request an application from your local health center. Income verification documents are required before you submit your application. If you have no proof of income, please legibly write and send a Self Declaration letter that you receive no income and include it with your application.

You can also request an application from your local health center. Income verification documents are required before you submit your application. If you have no proof of income, please legibly write and send a Self Declaration letter that you receive no income and include it with your application.

Completed applications can be returned to:

Valley Health-Pea Ridge Business Center

Attn: Sliding Fee Coordinator

5636 US Route 60, Suite 1B

Huntington, WV 25705

Once eligibility is reviewed, patients will receive a letter notifying them of approval or denial. If approved, the patient will also receive a sliding fee card via U.S. mail, which will be valid for one year from the date of the application. Valley Health will adjust any charges incurred during the three months prior to the approval date.

Benefits/Nominal & Established Fees

The patient pays greater than the nominal fee or discounted charge. Payment is expected at the time of service.

Cash Discounts

Cash discounts are available to those patients who request them; however, some guidelines must be met.

- The patient must request a cash discount from their preferred provider’s office.

- No other payments can be applied, including insurance, special programs, or third-party payments.

- No other discounts have been applied to the charges.

- The patient account is in good standing and has not been transferred to a collection agency.

- After the cash discount is offered, payment in full (minus the discount) must be received within thirty (30) business days.

- Exceptions:

- Optometry

- Patients paying in cash for contact and/or glasses will receive an automatic discount.

- Before being ordered, glasses and/or contacts (minus the discount) must be paid in full.

- Dental

- Payment for major dental services or appliances (minus the discount) must be paid in full by the insertion date or the date the service is completed.

- Optometry

Paying Your Bill

- Log on to Valley Health Portal

Good Faith Estimates

You can receive a “Good Faith Estimate” explaining how much your medical care will cost. Under the law, health care providers must give patients who don’t have insurance or are not using insurance an estimate of the bill for medical items and services.”

- You can receive a Good Faith Estimate for the total expected cost of any non-emergency items or services. This includes costs like medical tests, prescription drugs, equipment, and hospital fees.

- Ensure your healthcare provider gives you a Good Faith Estimate in writing at least one business day before your medical service or item. You can also ask your healthcare provider and any other provider you choose for a Good Faith Estimate before you schedule an item or service.

- If you receive a bill that is at least $400 more than your Good Faith Estimate, you can dispute it.

- Make sure to save a copy or picture of your Good Faith Estimate.

For questions or more information about your right to a Good Faith Estimate, visit www.cms.gov/nosurprises